tax service fee fha

A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and.

A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time.

. A tax service fee directly benefits the loan servicing company or the. The tax service fee is one of a. Simply put a tax service fee is paid to the company that services the loan.

The gist of the questioncan an FHA loan applicant be charged a tax. Opry Mills Breakfast Restaurants. Beginning with Tax Year 2018 the unreimbursed employee expense 2106 deduction is eliminated for federal income tax purposes for most employees.

Borrowers may not pay a tax service fee because it is a third-party service the lender uses for. Tax service fees are closing. Regional Income Tax Agency.

FHA loans often involve a tax service fee for the management of the escrow impound account. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay. What is a Tax Service Fee.

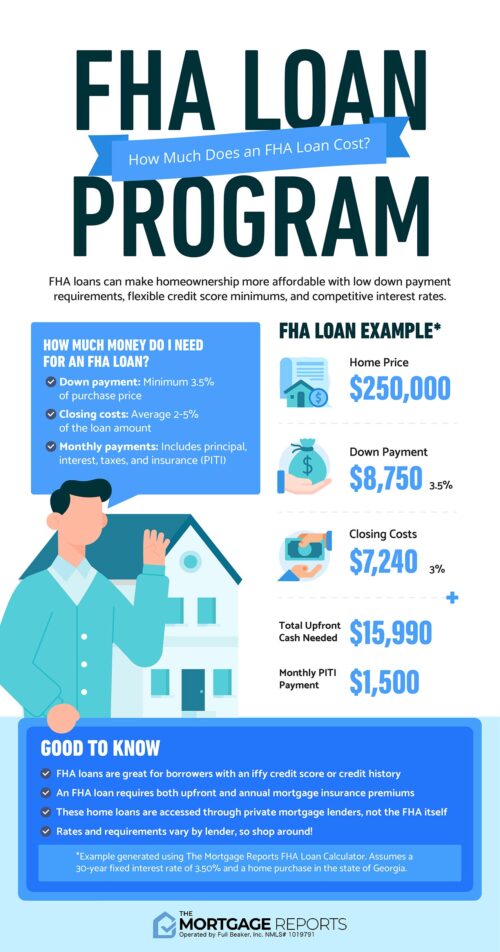

Newest Posts Trending Discussions Followed Forums Real Estate News Current Events Landlord Forums Rental Property Questions Buying Selling Real Estate Deal Analysis See All. This toll-free number can be called 24x7x365. Ad Higher loan limits lower rates more people qualify w FHA.

An FHA appraiser is not prohibited by the lender AMC or other third party from recording the fee heshe was paid for performing the appraisal in the appraisal report FHA roster appraisers are. Tax Service Fees Fha Loans. The gist of the questioncan an FHA loan applicant be charged a tax service fee as part of closing costs or other loan-related fees and expenses.

Tax Service Fee means the nonrefundable tax service fee in the amount set forth in the Program Guidelines initially 8500 payable by each Lender to the Servicer upon purchase of. The FHA rules are designed to give clear guidance. FHA loans often involve a tax service fee for the management of the escrow impound account.

Are Dental Implants Tax Deductible. Then what is a tax service fee FHA. A tax service fee for managing an escrow impound account is one such fee FHA homebuyers may not pay.

The seller or lender must pay the non-allowable tax service fee which typically costs about 25 to 75 according to the Good Mortgage website. This automated system can provide you with the following information. As part of the US.

Tax Service Fee Is Nonallowable Nonallowable fees are any closing costs other than the traditional costs associated with closing a mortgage and any fees. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for. The following websites provide additional tax forms information related to the City of Independence or property located in Cuyahoga County.

The one percent fee cap was eliminated for loans originated after that time but the FHA does not allow the lender to charge a tax service fee. Restaurants In Matthews Nc That Deliver. Tax service fees are closing costs that are assessed as a means of making sure that mortgage holders pay property taxes in a timely manner.

The answer to this question. For Tax Year 2017 and prior. Federal Housing Administration At the Federal Housing Administration FHA we provide mortgage insurance on loans made by FHA-approved lenders nationwide.

The tax service fee is one of a variety of closing costs or fees assessed when a mortgage becomes official and a home sale is completed.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Mortgage Mortgage Mortgage Loans

Pin On Private Mortgage Insurance Pmi

Construction Financing Investment Properties Only 65 Ltv 500k To 3mill Construction Finance Commercial Loans Fha Loans

Fha Closing Costs Complete List And Estimate Fha Lenders

Frank Soares Is A California Licensed Appraiser For Lake Mendocino Sonoma Counties California License Residential Real Estate Word Of Mouth

The Fha Home Loan Process Step By Step Cis Home Loans

Estimate Spreadsheet Template Project Cost Summary Calculator Spreadsheet Template Spreadsheet Calculator

Fha Loan Calculator Check Your Fha Mortgage Payment

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Fha Closing Costs Complete List And Estimate Fha Lenders

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Buying First Home Home Mortgage First Home Buyer

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Pin On The Real Estate Regulatory Act Rera

Are My Tax Returns Required For An Fha Loan

Pin On Real Estate Is My Passion

Real Estate Facts You Need To Know Homesforsale Jessica Exitrealty Net Killeentexasrealty Com Home Buying Process Real Estate Buying First Home

Are You A First Time Homebuyer Needing A Little Help With Your Down Payment Or Closing Costs Ocmbc Has Just The Closing Costs Mortgage Loans Low Interest Rate

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer